- Home-icon

- શૈક્ષણિક સમાચાર (Educational News)

- _ઓનલાઈન શિક્ષણના વિડીયો (ONLINE EDUCATION VIDEOS)

- __ધોરણ 1 (ધોરણ ૧)

- __ધોરણ 2 (ધોરણ ૨)

- __ધોરણ 3 (ધોરણ ૩)

- __ધોરણ 4 (ધોરણ ૪)

- __ધોરણ 5 (ધોરણ ૫)

- __ધોરણ 6 (ધોરણ ૬)

- __ધોરણ 7 (ધોરણ ૭)

- __ધોરણ 8 (ધોરણ ૮)

- __ધોરણ 9 (ધોરણ ૯)

- __ધોરણ 10 (ધોરણ ૧૦)

- __ધોરણ 11 (ધોરણ ૧૧)

- __ધોરણ 12 (ધોરણ ૧૨)

- _Primary School (પ્રાથમિક શાળા સમાચાર)

- _Paripatra (ઉપયોગી પરીપત્રો)

- _Std 1 to 12 Text Books (ધોરણ ૧ થી ૧૨ના પાઠયપુસ્તકો)

- _LEARNING OUTCOMES (અધ્યયન નિષ્પતિઓ)

- _CCC EXAM MATERIALS (સીસીસી પરીક્ષા મટેરિયલ)

- નોકરી સમાચાર (JOBS NEWS)

- _Latest Jobs (નોકરીની હાલની જાહેરાતો)

- _MATERIALS (મટેરિયલ)

- _Call Letters/ Hall Tickets (કોલ લેટર /હોલ ટીકીટ)

- _ANSWER KEY (આન્સર કી)

- _Results (રીઝલ્ટ)

- HEALTH TIPS (આરોગ્ય હેલ્થ ટિપ્સ)

- LATEST ANDROID APPS (એન્ડ્રોઇડ એપ્લિકેશનનો ખજાનો)

- GOVERNMENT SCHEMES (સરકારી યોજનાઓ)

- ગુજરાતી વેબસાઈટ

Ticker

6/recent/ticker-posts

How To Check Adhar Card and Pan Card Linked Successfully or Not

How To Check Adhar Card and Pan Card Linked Successfully or Not

WELCOME TO WWW.KAMALKING.IN EDUCATIONAL AND LATEST JOBS UPDATES PORTAL.

Linking your PAN card with Aadhaar has been made mandatory for certain services, such as filing your income tax returns. As per a recent directive from the Central Board of Direct Taxes (CBDT), the last date to link PAN with Aadhaar is 30 June 2021.

|

| ADHARCARD LINKED TO PANCARD |

If you want to link your Aadhaar with your PAN card, you can visit 'How to Link Aadhaar Card and PAN Card' for more information

If you have already linked/seeded your PAN with your Aadhaar, you can check the status both online as well as offline.

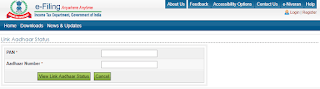

The Income tax Department's e-Filing portal provides an easy and simple way to link your Aadhaar card with PAN card as well as to check the same.

Simply Follow The Below Steps To Check The Status Of Your Pan Card Seeding With Aadhaar.

Visit www.incometaxindiaefiling.gov.in/aadhaarstatus

Enter PAN and Aadhaar Number

Click on 'View Link Aadhaar Status'

The status of the linking is displayed in the next screen

IMPORTANT LINK::

તમારું આધારકાર્ડ પાનકાર્ડ સાથે લિંક છે કે નહીં તે જાણવા માટે ની લિંક 2 અહીં ક્લીક કરો (ટચ કરો)

તમારું આધારકાર્ડ પાનકાર્ડ સાથે લિંક છે કે નહીં તે જાણવા માટે ની લિંક 2 અહીં ક્લીક કરો (ટચ કરો)

આધારકાર્ડને પાનકાર્ડ સાથે લિંક (જોડવા) માટેની વેબસાઈટ પર જવા માટે અહીં ક્લિક કરો (ટચ કરો)

To Link PAN with Aadhaar by sending an SMS. You need to follow the steps mentioned below:

Step 1: Type UIDPAN<12-digit Aadhaar><10-digit PAN> on your mobile

Step 2: Send it to 567678 or 56161

Originally, the deadline for linking PAN with Aadhaar was expiring on March 31, 2021, with the end of the current financial year. Failing to link the two would by the last date would render the PAN invalid

PAN-Aadhaar linking deadline extended to June 30 due to COVID disruptions

The last date to link Permanent Account Number (PAN) with Aadhaar number has been extended till June 30, 2021. The decision was taken considering the disruption caused by COVID-19, said the Income Tax Department on Wednesday.

Originally, the deadline for linking PAN with Aadhaar was expiring on March 31, 2021, with the end of the current financial year. Failing to link the two would by the last date would render the PAN invalid.

"Representations have been received from taxpayers that the last date for intimating the Aadhaar number may further be extended in the wake of the ongoing COVID-19 pandemic. Keeping in view the difficulties faced by the taxpayers, the central government has issued notification today extending the last date for the intimation of Aadhaar number and linking thereof with PAN to June 30, 2021," the tax department said.

Central Government extends the last date for linking of Aadhaar number with PAN from 31st March, 2021 to 30th June, 2021, in view of the difficulties arising out of the COVID-19 pandemic.(1/2)@nsitharamanoffc@Anurag_Office@FinMinIndia

Income Tax India (@IncomeTaxIndia) March 31, 2021

◾ALSO READ:

▪️ADHARCARD ALL LATEST UPDATES

▪️PAN CARD ALL LATEST UPDATES

The I-T Department also announced that the last date for issue of notice under Section 148 of Income-tax Act,1961, passing of consequential order for direction issued by the Dispute Resolution Panel (DRP) and processing of equalisation levy statements have been extended to April 30, 2021.

Date for issue of notice under section 148 of Income-tax Act,1961, passing of consequential order for direction issued by the Dispute Resolution Panel (DRP) & processing of equalisation levy statements also extended to 30th April, 2021.(2/2)

Income Tax India (@IncomeTaxIndia) March 31, 2021

Why do you need to link PAN and Aadhaar

As per Section 139AA of Income-tax Act, it is mandatory for every person to quote their Aadhaar number in their income tax return and the application for allotment of PAN, provided they are eligible for Aadhaar. Every person who has been allotted PAN as of July 1, 2017, and who is eligible to obtain Aadhaar number is required to link his PAN to Aadhaar.

ALSO READ:: HEALTH TIPS | LATEST JOBS

What happens if you don't link PAN and Aadhaar

As per the new Section 234H of the Income-tax Act, a person who does not link their PAN with Aadhaar will have to pay a penalty up to Rs 1,000. The amendment was introduced in the Finance Bill 2021.

If the PAN and Aadhaar are not linked by the last date, the former will be termed invalid. Once this happens, the PAN holder will be unable to file their income tax returns, conduct financial transactions that require PAN, or avail of government benefits like pension, scholarship, LPG subsidy, etc.

Taxpayers who have not linked their PAN and Aadhaar will also have to pay higher TDS and TCS.

Your deactivated PAN will become active once it is linked with your Aadhaar.

◾ALSO READ: LATEST GOVERNMENT SCHEMES

How to link PAN with Aadhaar online

1. Visit the I-T Department's official website - incometaxindiaefiling.gov.in

2. Go to 'Link Aadhaar' section mentioned on the left side of the portal.

3. Here, fill in your PAN number, Aadhaar number, name and the CAPTCHA.

4. Click on the 'Link Aadhaar' option.

5. The I-T Department will validate your details, thereafter your PAN-Aadhaar linking will be completed.

Link Aadhaar card to PAN card via SMS

From your registered mobile number type UIDPAN, PAN and Aadhaar number and send them to 567678 or 56161. For example, Type UIDPAN (12-digit Aadhaar number), SPACE (10-digit PAN), and send it to 567678 or 56161.

Link Aadhaar card with PAN manually

In order to link the documents manually, visit a service centre for your PAN card and fill the 'Annexure-I' form. Attach the form with a copy of the PAN and Aadhaar cards. With this method, an individual will have to pay a prescribed fee, unlike the online linking which is free.

GOOGLE AD

Contact form

Labels

- 11-12 science

- 1BHK HOME PLAN

- 2BHK HOME PLAN

- 360 VIEW

- 3BHK HOME PLAN

- 4BHK HOME PLAN

- 5G NETWORK

- 7th Pay Committee

- 8th CENTRAL PAY COMMITTEE

- 8th CPC

- AADHAR CARD

- adharcard

- ADHARDISE

- ADHYAYAN NISHPATIO

- ADMISSION

- ADSENSE

- AEI

- AFFILIATE MARKETING

- After Std 12th???

- age limit

- AGRICULTURE

- AI

- AIRTEL SCHEME

- ALL NEWS PAPERS

- AMAZON

- AMUL

- Android App

- Answer Key

- ANTI VIRUS APP

- APAAR CARD

- APAARCARD

- APL LIST

- APMC

- Application to Gov

- APPRENTICESHIP

- ARTICLE 35A

- ARTICLE 370

- ARTIFICIAL INTELLIGENCE

- ASTROLOGY

- ATM

- AUDIO

- AVAILABLE SEATS

- AYODHYA CASE

- AYURVEDIC

- Baby Names

- bad

- BAL SHRUSHTI MAGAZINE

- BALVATIKA

- BANK

- BAOU

- BIRDS VOICE

- bisag

- BLO

- Blue Print

- BOOK

- BPL LIST

- BSF

- BSNL

- BUDGET

- BUSINESS NEWS

- Calculators

- CALENDAR

- call letter

- Call Letters

- CAMPAIGN

- CAR ON RENT IN INDIA

- CASH BACK

- cbse

- CBT

- ccc

- CCC EXAM MATERIAL

- CCC+

- CCE

- Central Government

- CET

- CGL

- CGPA

- CHARGER

- CHAT GPT

- CIRCULAR

- CISF

- CLAT

- Clerk

- CMAT

- CNG

- COAST GUARD

- Computer

- CONSTITUTION

- CORONAVIRUS

- COURT

- CPF

- CRC-BRC

- CREDIT

- CRICKET

- CRPF

- CRYPTO CURRENCY

- CTET

- CURRENCY

- current

- CYCLONE

- D.EL.ED.

- DA

- DAILY CURRENT AFFAIRS

- DAYARO

- DEBIT CARD

- DEFENCE

- DEPARTMENTAL EXAM

- DEVOTIONAL

- DGVCL

- Dictionary

- DIGITAL GUJARAT

- Digital India

- Digital Locker Service

- DIKSHA APP

- DIPLOMA

- Disaster Management

- DISE CODE

- DISTANCE LEARNING

- DIVYANG

- DOCUMENT VERIFICATION

- DONATE CAR TO CHARITY CALIFORNIA

- DRAWING

- Driving licence

- E-MAGAZINE

- EARN MONEY ONLINE

- EBC

- Eclipse

- ECONOMICS

- Education Department

- education of Out States

- EDUCATIONAL NEWS

- EDUSAFAR

- ele

- ELECTION

- ELECTRIC EQUIPMENT

- ELECTRIC VEHICLES

- english

- EPF

- ESSAY

- EXAM DATE

- excel

- EXTERNAL EDUCATION

- FEE PAYMENT

- FEE REFUND

- Festival

- fic

- FILE

- FINAL ANSWER KEY

- Finance Dept

- FIT INDIA

- fix pay

- FIXED DEPOSIT

- FLIPKART

- FLN

- FLOOD

- font

- FOREST

- form

- G-SHALA APP

- GAD

- GADGET

- game

- GAS

- GATE

- GCAS PORTAL

- GCERT

- GEOGRAPHY

- GEOMETRY

- geovernment scheme

- GET DAILY MESSAGE

- GETCO

- GHARE SHIKHIYE

- GHIBLI IMAGE

- Gift City

- GIRNAR PARIKRAMA

- Gk

- GMAIL

- Gold-Silver Price

- government Employees

- government scheme

- GPAT

- GPF

- GPS

- GPSC

- GPSC DAILY UPDATES

- GPSSB

- GR

- GRADE PAY

- GRADUITY

- GRAMMAR

- GRANT

- GRAPH

- GREENHOUSE

- GSEB

- GSEBESERVICE

- GSET

- GSRTC

- gssb

- GSSSB

- GST

- GUEEDC

- GUJARAT PAKSHIK

- GUJARAT TOURISM

- GUJARAT UNIVERSITY

- gujarati

- gujcet

- gunotsav

- GYAN KUNJ

- GYAN SADHANA

- GYAN SAHAYAK

- GyanParab

- GYANSETU

- GYANSETU SCHOOL

- GYANSHAKTI SCHOOL

- HACKING

- Hair Problem

- hall ticket

- HANTAVIRUS

- HEALTH DEPARTMENT

- HEALTH TIPS

- Help Line

- HERITAGE

- HETUO

- HIGH COURT

- HIGHER PAY SCALE

- Hindi

- HISTORY

- HITESHPATELMODASA

- HMAT

- HNGU

- HOLIDAYS

- HOME LEARNING

- HOME LOAN

- HOROSCOPE

- HOSPITAL JOBS

- HOSTEL

- HOW TO

- HRA

- HSC

- HTAT

- I KHEDUT YOJANA

- IBPS

- ICDS

- ICE RAJKOT

- IELTS

- IIM

- IIT

- IJAFO

- income tax

- INCREMENT

- INDIAN AIR FORCE

- Indian Army

- INDIAN COAST GUARD

- Indian Navy

- Inspire Award

- insurance

- Internet

- interview

- INVESTMENT

- IPHONE

- IPL

- IPO

- ISRO

- ITI

- JAM

- Javahar Navodaya

- JEE

- Jilla Fer Badali

- JIO

- JIOGIGAFIBER

- job

- JRF

- JYOTISH

- KENDRIYA VIDYALAYA

- KGBV

- KHADI

- KHEDUT

- KHEL SAHAYAK

- KHELMAHAKUMBH

- KIDS

- Language

- LATEST MOBILE

- LC

- LEARNING OUTCOMES

- LIC

- LIVE DARSHAN

- LIVE TELECAST

- LOANS

- LOCKDOWN

- LOGBOOK

- LOGO

- LOKSABHA

- LPG

- LTC

- MAHABHARAT

- MAHEKAM

- MAPS

- MARI YOJANA WEBSITE

- MARUGUJARAT

- MASIK PATRAK

- MASVAR AAYOJAN

- MATDAR YADI

- MATERIAL

- Mathematics

- MATHS-SCIENCE KIT

- MATRUTVA RAJAO

- MDM

- MDRA BILL MERA ADHIKAR

- MEDIA

- medicine

- MEDITATION

- MEENA RADIO

- MERIT

- Mesothelioma

- META

- MGVCL

- MICROSOFT

- MINA NI DUNIYA

- MISSION VIDHYA

- Mob Restrict

- MOBILE

- MODEL PAPERS

- model school

- MODULE

- MONGHVARI

- MORTGAGE

- MOVIE

- MP3

- MRP

- MS UNIVERSITY

- MUSIC

- MUTUAL FUND

- My Article

- MYSY

- Nagarpalika Jobs

- NAMO LAKSHMI YOJANA

- NARENDRA MODI

- NAS

- NATAK

- National Highways

- NCERT

- NDA

- NEET

- NEP 2020

- NET

- NEW EDUCATION POLICY

- New Jobs

- NEWS

- NFSA

- NIBANDH

- NMMS

- NOKIA

- notification

- NPS

- NREGA

- NTSE

- NURSING

- OBC

- OJAS JOBS

- old papers

- OMRSHEER

- ONGC

- ONLINE ATTENDANCE

- ONLINE BILL PAYMENT

- ONLINE BOOKING

- Online Material

- ONLINE SHOPPING

- ONLINE TEACHER TRANSFER

- OROP

- PAGAR BILL

- PAN

- panchayat

- paper solution

- Pari

- PARIKSHA AAYOJAN

- PARIKSHA PE CHARCHA

- Paripatra

- Pass

- PASSPORT

- PAT

- patrako

- PAY SCALE

- PAYTM

- PEDAGOGY

- Penshan

- PERCENTILE RANK

- PET

- PETROL-DIESEL-LPG PRICE

- PFMS

- PGVCL

- PH

- PhD

- PITRUTVA RAJAO

- PM AWAS YOJANA

- PM CARES FUND

- PM Kisan Samman Nidhi

- PM WANI SCHEME

- PM YASHASVI Scolarship Scheme

- PM-JAY

- PMMVY

- PMSYM

- POEMS

- police

- POLITICAL NEWS

- Post Office

- PRADHAN MANTRI SHRAM YOGI MAN DHAN YOJANA

- pragya

- PRAPTA RAJA

- PRATIBHASHALI VIDHYARTHI

- Pravasi Shixak

- Praveshotsav

- PRAYER

- PRESS NOTE

- PRET

- PRIMARY SCHOOL

- PROVISIONAL ANSWER KEY

- PSE-SSE

- PSYCHOLOGY

- PTC

- PUC CERTIFICATE

- PUZZLES

- QR CODE

- QUIZ

- railway

- RAILWAY RECRUITMENT

- RAJAO

- RAKSHASHAKTI SCHOOL

- RAM MANDIR

- Ramayan

- RATH YATRA 2018

- RATIONCARD

- RBI

- READING CAMPAIGN

- RECHARGE

- REDMI

- Reservation

- result

- Results

- REVIEW

- REWARD

- RINGTONE

- RIP

- Rojagar

- Rojagar News Paper

- ROJNISHI

- RRB AHMEDABAD

- RTE

- RTI

- RTO

- SAINIK SCHOOL

- SALANG NOKARI

- SAMARTH

- sangh

- SANSKRIT

- SARKARI YOJANA

- SAS GUJARAT

- SBI

- SC

- SCE

- Scholarship

- SCHOOL JOBS

- SCHOOL MERGE

- SCHOOL OF EXCELLENCE

- science

- SEB

- secondary school

- SELECTION LIST

- SELL

- Service Book

- SHALAKOSH

- SHARE MARKET

- Shikshan Sahayak

- SHIXAK JYOT

- SI

- SOE

- SOFTWARE

- SOLAR ENERGY

- Song

- SPEECH

- SPELLING

- SPIPA

- SPORT

- SS

- SSA

- SSC

- STAFF SELECTION COMMISSION

- STANDARD-1

- STANDARD-10

- STANDARD-11

- STANDARD-12

- STANDARD-2

- STANDARD-3

- STANDARD-4

- STANDARD-5

- STANDARD-6

- STANDARD-7

- STANDARD-8

- STANDARD-9

- STEM LAB

- STORY

- SUBSIDY

- SUKANYA SAMRIDDHI YOJANA

- SUPREME COURT

- SURVEY

- Svachchh Bharat

- SWIFTCHAT

- syllabus

- TABLET YOJANA

- talati

- TALIM

- TALUKA FER BADALI

- TAT

- TEACHER EDITION

- Teacher Seniority List

- TEACHERS CODE

- TECHNOLOGY

- TET

- TEXT BOOKS STD: 1-12

- TIKTOK

- time table

- TOLL FREE NUMBERS

- TPEO-DPEO

- TPT

- True copy

- TV

- UGVCL

- UNIT TEST

- UNIVERSITY NEWS

- UPCHARATMAK KARYA

- UPSC

- USEFUL WEBSITES

- VAGLE

- VALATAR RAJA

- VANAGI

- VANCHAN ABHIYAN

- VANDE GUJARAT

- VASATI GANATRI

- VAVAZODU

- VI NEWS

- video

- VIDHYASAHAYAK BHARATI

- VIGYAN MELO

- VIKALP CAMP

- Vikas

- VIKRAM SARABHAI SCHOLARSHIP

- VINOD RAO

- VIRAL VIDEOS

- VIRTUAL CLASSROOM

- VITAMINS

- VOTER LIST

- WAITING LIST

- WATERPARKS

- weather

- WEATHER FORECAST

- WINDY

- WORLD CUP 2019

- WORLD'S LARGEST

- XIAOMI

- YOGA

- YOUTUBE

- हिन्दी

- ગ્રામર

- વ્યાકરણ

Ad Space

Random Posts

3/random/post-list

Recent in Jobs

3/job/post-list

Popular Posts

Created By VKTemplates | Distributed By Blogger Theme Developer